Introduction

In 2025, finance apps have become smarter, safer, and more personal. From budgeting to investing, these apps help users manage money efficiently and make informed financial decisions.

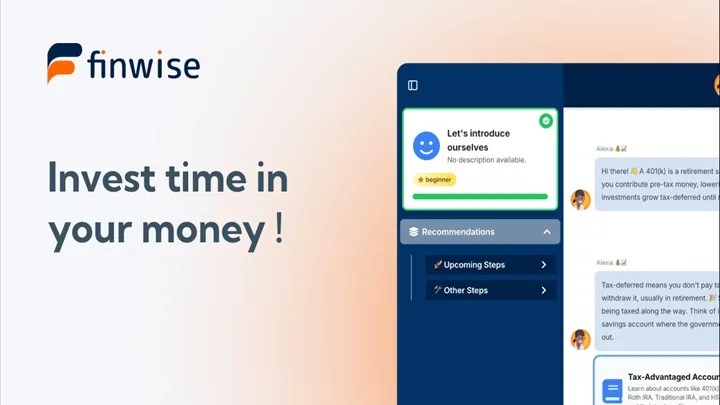

1. FinWise AI – Your Smart Money Assistant

Category: Personal Finance

FinWise AI helps you stay on top of your budget:

- AI-generated spending insights

- Smart budgeting by category

- Real-time balance and alerts

- Bill reminders and automation

- Secure cloud syncing

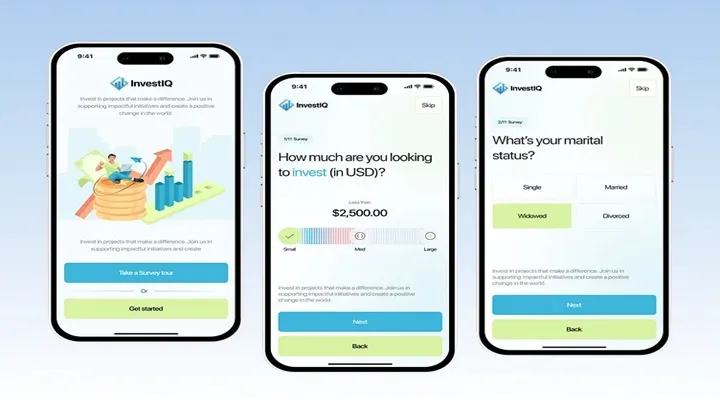

2. InvestIQ – Smarter Investing for Everyone

Category: Investment & Stocks

InvestIQ makes investing simple and accessible:

- AI-driven portfolio analysis

- Real-time stock and crypto tracking

- Risk management insights

- Fractional shares investment

- Personalized investment strategies

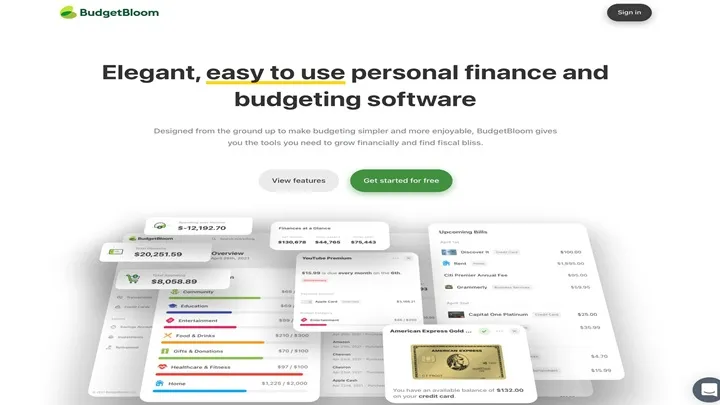

3. BudgetBloom – Financial Growth Simplified

Category: Budgeting & Planning

BudgetBloom helps you reach your goals:

- Visual financial planning tools

- Savings challenges and progress tracking

- AI suggestions for cost-cutting

- Multi-account integration

- Monthly financial reports

4. CoinPath – The Future of Digital Assets

Category: Cryptocurrency Management

CoinPath keeps your crypto secure and optimized:

- AI trading signals and analysis

- Portfolio performance tracking

- Secure multi-wallet connection

- Market trend visualization

- Real-time price alerts

5. WealthLink – Financial Education & Advice

Category: Finance Learning

WealthLink empowers users through knowledge:

- Bite-sized financial lessons

- AI quizzes and progress tracking

- Real-world case studies

- Expert-curated investment guides

- Community for financial discussions

Conclusion

The Top 5 Finance & Investment Apps of 2025 — FinWise AI, InvestIQ, BudgetBloom, CoinPath, and WealthLink — combine smart analytics, automation, and education to make financial management easier and more rewarding.